Business leaders from Uber and transit officials with the Southwest Ohio Regional Transit Authority gathered yesterday to announce a new partnership between the region’s largest transit provider and the increasingly omnipresent ridesharing service.

As part of the partnership, Metro will place interior transit cards on buses advertising a unique code that will offer a free ride to first-time Uber users. While the deal is similar to Uber’s many other marketing relationships, it may be the first step toward greater collaboration between the two organizations.

“Many of our customers have expressed their interest in using rideshare services like Uber in conjunction with their Metro trip to bridge the gap between service hours and locations,” Metro CEO & General Manager Dwight A. Ferrell said in a prepared release.

In other cities, like Dallas and Atlanta, Uber has partnered with regional transit agencies to integrate their mobile app with the route planning offered within the transit agency’s app. However, these relationships have been critiqued for what being a lopsided arrangement favoring the fast-growing tech company.

Other partnerships looking to address the first mile, last mile challenge have so far struggled to amount to much, but this has not stopped transit officials in Minneapolis and Los Angeles from inking deals to cover trip costs on Uber as part of their respective guaranteed ride home programs.

Such issues, however, are not deterring Metro officials from looking at the potential upsides that might come out of the partnership.

“We’ve seen the significant success Uber has had with other major public transit providers,” Ferrell stated. “We believe Uber is an ideal partner to help us meet the needs of our customers, ultimately making their experience as convenient and enjoyable as possible.”

If the partnership is successful, it could create significant value for Metro riders and help tackle one of the most difficult challenges facing transit agencies throughout North America – how to get riders to and from transit stations without the use of a personal automobile. Eliminating such a problem would allow many people to significantly reduce their reliance on a personal automobile, or eliminate it altogether.

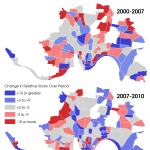

![Uber and Public Transit Pairing [FiveThirtyEight]](http://www.urbancincy.com/wp-content/uploads/2016/03/Uber-and-Public-Transit-Pairing.png)

“Cincinnatians are already combining Uber and Metro to reach their destinations and we are excited to partner to spread the word further that Uber is an option to take Metro riders that ‘Last Mile,’” said Casey Verkamp, general manager of Uber Cincinnati.

Verkamp and Ferrell are right in being optimistic about the potential. An analysis by FiveThirtyEight found that people the combined cost of public transit and Uber becomes more cost effective than owning a personal automobile when the person uses public transit for approximately 85% of their trips and Uber for the rest.

With the average household making 2,000 trips annually, that equates to roughly 300 Uber trips per year. Of course, the average Cincinnatian takes far fewer than 1,700 trips per year on public transit, so a fully functioning arrangement of this kind would be hugely beneficial for both Uber and Metro. The main problem in Cincinnati is that the vast majority of people living in the region are not well-served by transit, and are essentially unable to take 85% of their annual trips by public transit.

Nevertheless, this is the first partnership of its kind in Ohio. While its limited scope leaves much unanswered about how it will benefit area transit riders over the long-term, it does illustrate that Metro officials are thinking about the future of how to move people effectively and efficiently throughout the region.

“This partnership exemplifies how cities like Cincinnati are embracing innovation and creative solutions to meet the needs of their residents,” Verkamp concluded.