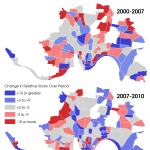

For those coming from the west side along the Ohio River, Cincinnati’s western riverfront serves as a bit of a welcome mat. However, after losing residents and jobs since mid-20th century, many in the area believe now is the time to rethink this historic area.

While oft-viewed as an industrial stretch, it is a little known fact that Cincinnati’s western riverfront is actually one of the region’s largest green corridors with riverfront parks and wooded hillsides. And just a few feet down from the busy streets and railways, there is a different Cincinnati – one community leaders believe has the potential to serve as a national example of environmental stewardship and urban recreation.

Perhaps the biggest asset this area boasts is the Ohio River with its views and access to unique amenities. The existing amenities offered by the river and surrounding hillsides, combined with potential amenities from a string of riverfront parks, have the ability to create a powerful attraction for new residents and jobs. It is because of this potential that community leaders see so much value in Ohio River Trail West, which is part of the city’s larger Western Riverfront Plan.

The proposed three-segment first phase of Ohio River Trail West. formerly known as the Western Riverwalk, ties together the reconstruction of the Waldvogel Viaduct, ongoing redevelopment in Lower Price Hill, and repurposing of the former Hilltop Concrete property into a park.

URS estimates that the first two segments within the first phase of work will cost approximately $1.3 million and build upon the much larger Ohio River Trail. This particular phase of trail would extend roughly 3.7 miles downriver to the Gilday Recreation Center.

The biggest of these three pieces of the puzzle is the $55 million reconstruction of the Waldvogel Viaduct. As part of the planning and engineering of the new viaduct, there will be improved views and access to the river from Lower Price Hill. Once the viaduct’s construction is complete, more than 16 acres of riverfront property will become accessible at the former Hilltop Concrete site, which had once been planned for a new rail-to-barge shipping facility, and will now become Price’s Landing.

The combination of all these ongoing efforts creates the possibility for a dramatically different future for the long-troubled Lower Price Hill neighborhood.

Olyer School – an architectural treasure and a foundation of the Lower Price Hill community– recently underwent a $21 million dollar renovation; and the reconstruction of the Waldvogel Viaduct will reconnect the neighborhood to the river for the first time in over 60 years.

Meanwhile, the western end of the first phase of Ohio River Trail West is the Gilday Recreation Center, which will support the trail through its current configuration and planned upgrades.

It is estimated that the stretch of properties between the former Hilltop Concrete site and Southside Avenue are controlled by no more than five entities, and project planners have already secured roughly 70% of the right-of-way needed for this first phase of work.

So while ownership and access are typically major hurdles for projects of this variety, proponents are particularly excited that all of the needed right-of-way required for the first phase of work is either controlled already, or is vacant and potentially available for the new trail. Furthermore, each endpoint is owned by the City and will be able to provide both access and parking for future users.

The efforts to make this plan a reality were given a boost by former Cincinnati Mayor Mark Mallory (D) when he delivered his final State of the City Address and made the western riverfront a key component of that speech.

“If you think about the proposed investment here…this could serve as a landmark development for the west side of Cincinnati,” Mallory stated.

The efforts were then given another jolt in April 2014 when current Cincinnati Mayor John Cranley (D) allocated $250,000 to the project for ongoing engineering work, and pledged to support the project going forward.

There is currently no timetable for phase one construction activities, but project proponents hope to finalize engineering work and secure construction funding for phase one over the next year or so.