Recently UrbanCincy contributor Timothy Broderick sat down with Ronald Vieira, founder of PassivHaus — a venture designed to shake up the region’s building industry by dramatically reducing buildings’ energy expenditures to discuss building Passive Houses in the Cincinnati region. The interview has been edited for clarity and length.

Who are you?

My name is Ronald Vieira. Graduated from Xavier class of 2016. Born and raised in Valencia, Venezuela, but Cincinnati is my hometown. I like that I come from here.

What’s your job?

I am doing research to figure out how to decrease the extra payment people have to pay to build a passive house (PH). And that research consists in building the first PH in Cincinnati. There are a few PHs in construction in Cincinnati currently, but none of them have been certified yet.

What’s a passive house?

A PH is a building standard, a series of building standards that, if followed properly, you will reduce up to 90% of your heating load of your house, building, whatever your facility is. Overall it reduces up to 75% of your overall energy consumption.

How does it achieve such efficiency?

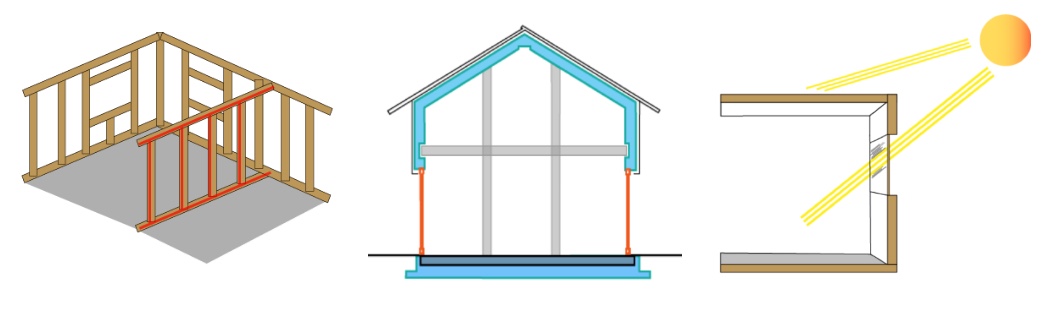

The main principle is super insulation — or as they call it, continuous insulation — because the idea is to isolate as well as we can the inside temperature of the house from the outside environment. Whether the outside is hot or cold or mild or humid or not it’s just to preserve the indoor environment to the best of the indoor’s ability.

So you’re basically creating a very stabilized climate?

Mhmm. A good analogy is your skin, which are your “walls.” To stay warm when you go outdoors, you put a jacket on. Similarly, when you’re building a house, the plywood is the skeleton of the house and then you build another exterior wall and put a lot of isolating material, like foam, and then that’s your newer, thicker wall.

Then you look where house is more prone to exchange air with the outside, which is windows and doors. You have to have really high-efficiency building doors and windows. Twenty years ago, new houses had single pane windows. Now the standard is double paned windows, and for PHs the standard is triple-paned windows.

How do you keep the air from getting stale/moldy?

Since you basically don’t have any communication from inside air to outside air, the filtration system for a passive house is a little different. This is an add-on equipment that you put on top of your furnace which cleans the air and filters it way more than a standard house. A high-quality filter is super important to a PH because it is airtight and needs better quality air while still using a lot less energy.

The way you put it it sounds like this cool thing that everyone should be doing, but it can’t be that simple. What are the biggest barriers to wider implementation?

Let’s start with the cost, which is the easiest to explain. You need more material — two walls + filler, for example. Another cost driver is the talent to design these buildings. There were only a handful of certified PH buildings in the US in 2009. The materials and the talent sums up to a 10 to 20% more cost. Now, this is all weather sensitive. The larger the building is, and the colder the climate is, the less expensive it’s going to be. It’s easier to keep it cool in the summer. When I did market research in Cincinnati, I found that we won’t need to go over the 10% premium. This is the promise of my company in the first three years. Then, we are going to figure out how to build these houses at 0% extra at the end of the third year.

The second barrier is the learning curve. These houses use new material and new ideas that most builders and architects don’t know. However, if you have the same group of people who are building the first house and then the second house and the third, they will quickly learn the process. That’s what I’m going to do.

You, yourself, are still learning how to build a PH. How will you build the first one?

You just need a PH consultant, which is not hard to get. Paul Yankee is my mentor on PH design, and he is the owner and CFO of Green Buildings Consultants. He has been advising since Day 1.

Are you going to get certified?

Yes, not as a designer but as a builder. But my architects will be certified.

What’s your motivation behind this work?

Typically, I think a little bit more in the bigger picture than the smaller picture. When I graduated college, I wanted to do something that will significantly impact the life of people in the world. That’s where everything starts.

Why climate change and not global poverty or something like that?

I think it was the education I received. Venezuela is a developing country, so my mom’s side is very poor. All my life I had very personal contact with extreme poverty. I felt like I was more qualified to tackle a systemic, non-social challenge than a social challenge. Plus, climate change is science, and my first three years at Xavier were chemistry.

So climate change, turns out the largest emitter [in the United States] is residential living. Why aren’t people doing anything about this? That’s when the research starts: how do I get people to generate energy in a greener way, or how do I get these people to use their energy in more wisely.

This has to do with energy efficiency and energy generation. Energy generation is far more complex, and my technical ability is not there at all. But my ability to find out how to build buildings in a way that keeps energy and consumes a lot less energy — ok, now I can do that. Doing research on home energy efficiency is how I stumbled upon PHs.

Is this only for rich suburbanites? Can you build something in the city?

No. I’m currently looking at a lot close to downtown. Furthermore, anything and everything can be built passive. You can use any particular architecture style whether it is contemporary, whether it is a bungalow, whether it is classical, or civil war era. You can have any type of architecture built to PH principles.

Now what you’re getting at, renovating houses like in Over-the-Rhine, that’s the next big challenge for PH builders. It is possible, but it is just another design challenge because you have to deal with existing structures. For historic buildings, specifically those in OTR, those are going to have more aesthetic and cost challenges.

What’s your short-term goals?

The official mission is to accelerate the adaptation process of PH principles to home residential construction. And then we’ll send segue into commercial, and that means mixed, urban living. I have a particular affinity for urban spaces. I am from the most inner city you can ever be in Valencia. So that’s all I know, basically.

Endgame?

Getting a large organization — like 3CDC — in charge of redeveloping a lot of buildings, getting in with them — that’s the goal. But all my energy right now is focused on building that first house. Nothing more. Who knows from there.

If you’re interested in building your own passive house, visit Ronald’s website or shoot him an email at vieirarxu@gmail.com.