The U.S. Census Bureau released new population estimates for municipalities across the United States last week. The data showed that while Ohio’s big cities continue to struggle, Cincinnati and Columbus stand as outliers by posting consistent population growth.

According to the estimate, the City of Cincinnati now has 298,165 residents, which represents an increase of 547 over the previous year. While the metropolitan region is Ohio’s largest, Cincinnati is just the state’s third largest city after Cleveland (389,521) and Columbus (835,957), which has nearly three times as much land area as both Cincinnati and Cleveland.

Further reducing Cincinnati’s numbers is the reality that nearly 70,000 people live in the river cities directly across from Downtown in Northern Kentucky. While they are counted toward the regional total, they do not show up in the city’s overall population.

For Cincinnati it marked the third consecutive year of population gains since the Census Bureau disappointed city officials with their 2010 decennial count, which is a much more robust effort based on actual counts than the annual estimates. This comes after a half-century of population decline that not only defined the Queen City, but most established cities throughout the United States – a fact that while easily noticed also had many root causes that are difficult to ascribe.

Since this newly released data is not the hard count, one is not able to decipher where the population gains and losses are occurring throughout the city, but recent reports have shown strong population growth in Downtown and Uptown – a trend that is expected to continue over the rest of the decade.

For years leading up to the 2010 decennial count, Cincinnati officials had been challenging population estimates that showed declining population numbers. Those declining numbers were held up in that count, but now appear to be on the side of city officials who believe trends are now in their favor.

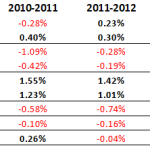

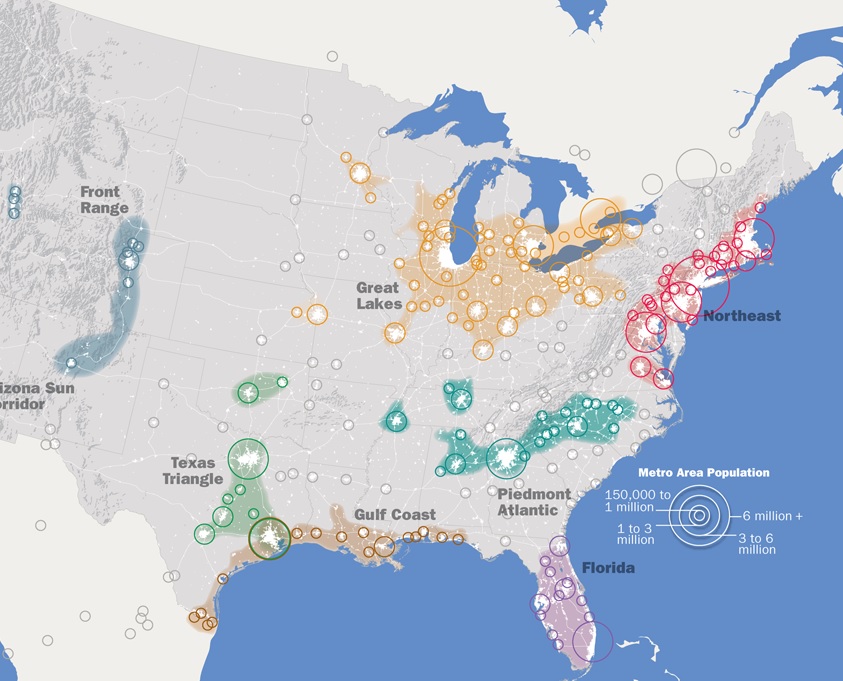

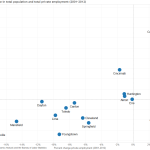

The growth in both Cincinnati and Columbus follow their regional population growth trends, although the City of Columbus is adding population at a faster rate than its region, while the City of Cincinnati is slightly trailing its regional population growth trends. Quite the opposite is true in Cleveland, where both the city and region are losing people, and the city is doing so at a faster rate.

While Cleveland stands as lone big metropolitan region losing population in Ohio, Toledo looks to be faring even worse. Since 2010, the City of Toledo has been losing more than 1,500 residents each year, while shedding a total of 3,000 residents region-wide since the decennial count.

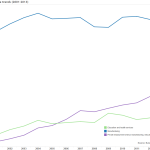

As UrbanCincy previously reported when updated regional estimates were released, if current trends continue Columbus will surpass Cleveland in 2017 and Cincinnati in 2024 to become the state’s largest metropolitan region.

With both Columbus and Cincinnati also leading the state in terms of their economic performance, it seems likely that their positions as population growth leaders will continue throughout the remainder of the decade.