Leaders in Uptown are looking for a way to further help and encourage small businesses to set up shop in region’s second largest employment center. The hope is that a new revolving loan fund will help make the business climate better for those small businesses who often have trouble with upfront capital.

Uptown Consortium President and CEO, Beth Robinson says that the decision to start such a fund came as a result of feedback received during its business retention and small business visits in 2012. Those involved expressed a frustration with being able to secure necessary upfront capital. So to help solve that, the Uptown Consortium funded a new Development Opportunity Fund with $500,000 of its own money last year.

“The whole purpose of these things is to create a supportive business environment,” Robinson explained. “We have coaching services, means of communicating and now this fund. We really want to support job creation. That’s what this is about.”

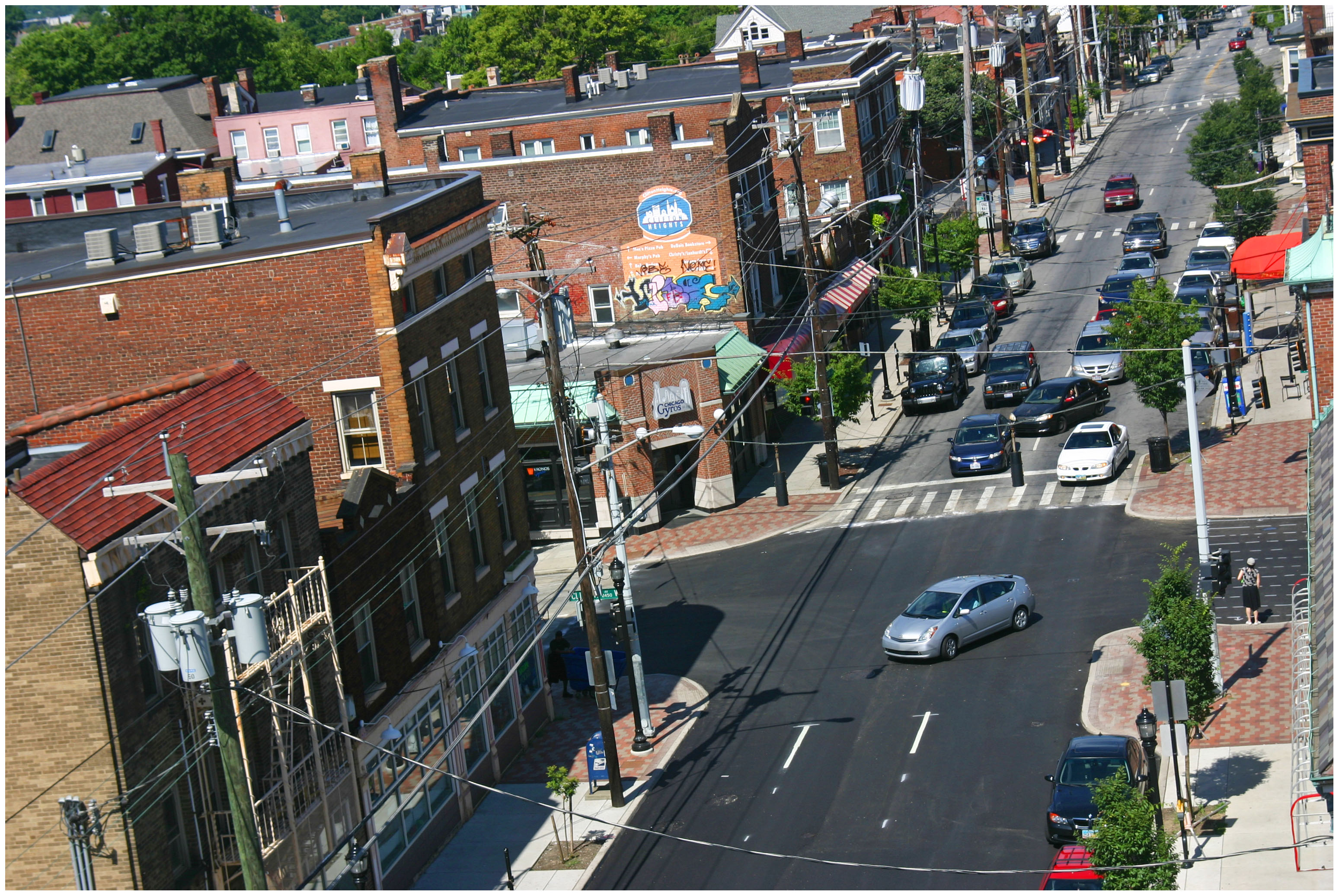

Uptown neighborhoods have seen a surge of private investment in recent years, but some small businesses are struggling to get involved. Photograph by Randy Simes for UrbanCincy.

Robinson says that the fund is intended to support capital costs of new or expanding small and mid-sized businesses in the Uptown area, but that since it is funded with their own money there is a great deal of flexibility with how the money can be used.

“We’re open to whatever grows jobs in Uptown, and whatever stabilizes and moves the business districts forward,” noted Robinson.

These types of funds are typically administered by government agencies, not development corporations like the Uptown Consortium. This, in and of itself, gives the fund the much greater flexibility leaders are touting and on loan requirements.

The first and only business to take advantage of the fund so far is Stag’s Barbershop, which used $10,000 to complete a 1,400-square-foot expansion in Avondale. As a result, the neighborhood institution now offers, for the first time since its opening in the 1950s, a full beauty salon with hair, nail and feet treatments.

What that means is that applicants can apply for loans of the $490,000 in remaining funds. Should the program demonstrate viability and demand, Robinson says that it could be extended and potentially expanded.

“Since we are looking at it as a revolving loan fund, if the demand is there and it is having our desired intention, then there might be the possibility of expanding it,” Robinson told UrbanCincy.

Officials say that there are several businesses in the pipeline for loans right now, but that they are taking things on a first-come, first-serve basis. Ideally, they say, the new or expanding businesses will be located within one of the five neighborhood business districts in the area: Clifton’s Ludlow Avenue, Avondale’s Burnett Avenue, Corryville’s Short Vine, Calhoun/McMillan Streets in CUF, and Auburn Avenue in Mt. Auburn.

Those interested in learning more about the Uptown Consortium’s small business outreach programs, including this Development Opportunity Fund, are encouraged to contact Janelle Lee at jlee@uptownconsortium.org.