State Senator Eric Kearney (D-Avondale) introduced a bill which would create a tax credit for landlords who improve the energy efficiency of their buildings. Senator Kearney hopes that the bill he introduced last month will encourage residential landlords to update their units and lessen the utility costs on their tenants.

State Senator Eric Kearney (D-Avondale) introduced a bill which would create a tax credit for landlords who improve the energy efficiency of their buildings. Senator Kearney hopes that the bill he introduced last month will encourage residential landlords to update their units and lessen the utility costs on their tenants.

“I received complaints from constituents who live in apartments that lack general upkeep and every month they pay for the lack of maintenance” Senator Kearney stated. “My constituents in rental units deserve to live in safe, eco-friendly environments that decrease their utility bills, and Senate Bill 310 provides landlords with positive incentive to make changes.”

If implemented, the bill would give residential landlords a 15 percent income tax credit for making upgrades by installing energy-saving devices, replacing aging appliances with Energy Star-rated appliances, sealing and insulating air ducts, and upgrading exterior wall windows and doors.

Improved sealing and insulation of duct work has been reported as saving as much as 20 percent in energy costs alone. Senator Kearney says that the idea of making these efficiency upgrades is one that benefits everybody, and one that is particularly relevant in today’s economy.

“Energy costs are rising and given the unfortunate state of our economy few people can afford increased utility bills, especially if they are related to a lack of maintenance.”

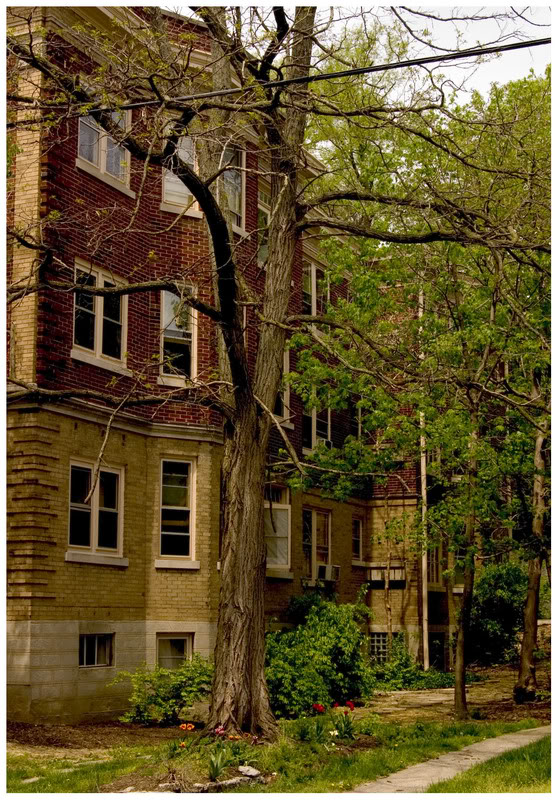

The proposed legislation does more than simply promote energy upgrades, it also incentivizes upgrades to historic structures which most often house renters in multi-unit dwellings within the city’s inner neighborhoods. The news comes on the heels of complimentary legislation introduced by Senator Kearney in September that proposed a 25 percent tax credit for the renovation of homes built before 1950 in low income neighborhoods.

“Both the property and the greater community benefit from home renovations. When homeowners invest in their properties the monetary value of the neighborhood increases along with its reputation.”