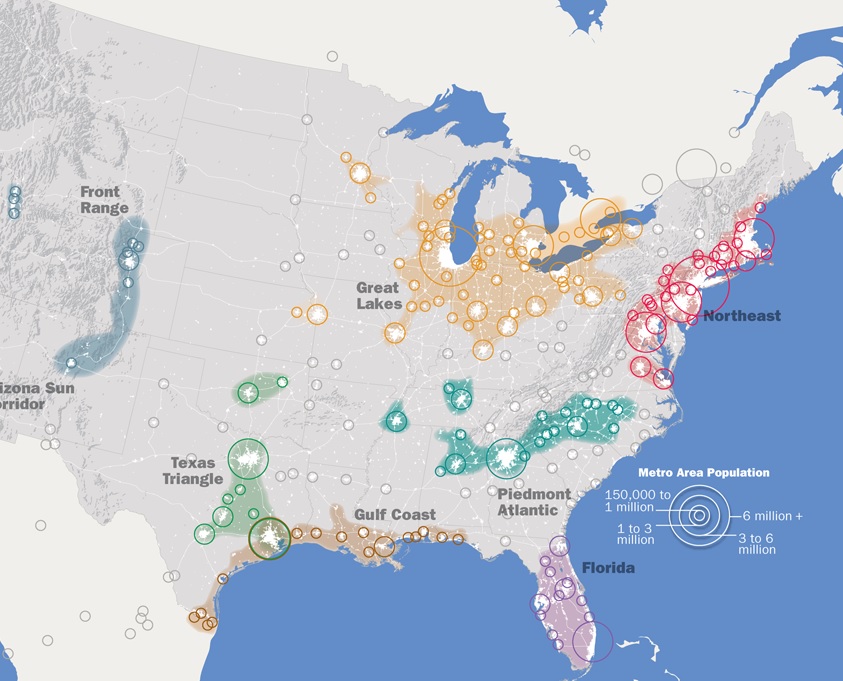

Is the Great Lakes region ready to start acting like a megaregion?.

Only a small piece of land between Cincinnati and Dayton remains undeveloped, and many believe that remaining gap will disappear very soon. But the merging of Cincinnati and Dayton as one large metropolitan region is only part of the story, as shared regional identities with other large urban centers throughout the Great Lakes region becomes more pervasive. This and other regions like it around the U.S. are becoming even more centralized. More from The Week:

Though the concept has existed in academia for decades, planners are now looking at these dense corridors of population, businesses, and transportation and wondering if the megaregion may, in fact, be the next step in America’s evolution. With renewed interest and investment in urban centers and the projected growth of high speed rail, megaregions could easily become home to millions more Americans.

The Northeast corridor, for example, could receive up to 18 million more residents by 2050, according to estimates from the Regional Plan Association. And the region encompassing major cities in Texas including Houston and Dallas could see a spike from roughly 12 million to 18 million people in that same time, the association says.

And where population goes, economic growth is not far behind. The Northeast corridor would be the fifth largest economy in the world, with the Great Lakes megaregion at ninth and the Southern California megaregion outpacing Indonesia, Turkey, and the Netherlands as the 18th largest, according to 2012 estimates from real estate advisory RCLCO. The problem is, there are challenges to making these networks hold together. Unlike megaregions in Europe and Asia, for example, the United States has traditionally shied away from large umbrella governing organizations which surpass state borders.